With venture-backed technology companies staying private longer than ever, how do investors go about accessing growth equity investments? EquityZen was started in 2013 to address this need for private market access. Our marketplace makes it easy to buy and sell shares of private companies through our funds.

Wondering where to get started? This guide will provide an overview of the pre-IPO market and a framework for investors to evaluate potential investment opportunities.

What is the private secondary market?

The private secondary market is one in which existing shareholders sell their shares to investors while a company is still private. Secondary transactions differ from primary transactions in that the shares are sourced from a selling shareholder, not the company itself. Therefore the proceeds of a secondary sale go to the selling shareholder instead of the company. In contrast, primary issuances happen when a company issues a new class of shares and grants those shares to employees (generally in the form of stock options) or sells them to investors to raise capital. The employees and investors who own primary shares may choose to sell them in the secondary market, through EquityZen, at a later date. Transactions in the secondary market are therefore called secondaries because they are one step removed from the primary stock issuance that originally created the securities.

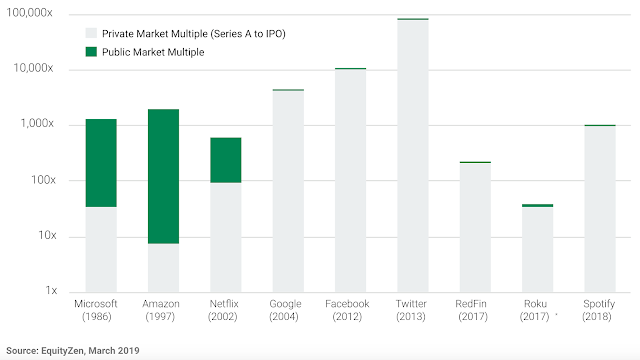

The graph above displays how value creation from 1986 through 2018 has shifted from the public markets (green) to the private markets (gray). Roku's private valuation multiple based on Series B to IPO. Companies shown may not be actual portfolio investments of any EquityZen fund.

Proliferation of secondaries & how you can take advantage

Given the cost of going public (which can be substantial in terms of time and resources)1 and the short-termism of the public markets (which can cause public companies to focus on quarterly earnings rather than long term growth)2, technology companies have fewer reasons to go public than they did a decade ago. In 1999, US technology companies typically went public after 4 years. Today, the average technology company IPOs after 10+ years.3 As a result, venture-backed technology companies are increasingly reaching $1B and even $10B valuations before they go public, which leaves less potential upside on the table for public market investors. There is estimated to be over $50 billion of value locked up in private, pre-IPO companies4. EquityZen’s secondary market is unlocking that value for investors who had previously been shut out due to high investment minimums and exclusivity.

Furthermore, because companies are waiting longer to go public, their earliest investors and employees have to wait longer for liquidity than they would have in the past. There are many reasons why early shareholders of now valuable private companies might want liquidity before an IPO. An early stage venture capital investor, for example, might want to return capital to limited partners ahead of the launch of a new fund. An early employee of a now late-stage company might want to sell shares to finance a major life event like buying a house. EquityZen’s secondary marketplace is here to help.

EquityZen acts as an intermediary between shareholders who need liquidity, and investors who want investment exposure to proven technology companies before they ultimately go public or get acquired. Once an investment is made, investors hold shares via an EquityZen fund until there is an exit event. If the company goes public, investors receive shares after the IPO lockup period (which restricts private market shareholders from selling their publicly traded shares, typically for 180 days). If the company gets acquired for cash, investors receive cash. EquityZen’s team manages the full secondary transaction process, from investment to exit, with expertise from closing over 35,000 secondary transactions in over 400 private companies.

![]()

Interested in exploring the private companies trading on EquityZen's marketplace?

Secondary market pricing: valuing a company's shares

While primary market pricing is set by the institutional investors who lead a financing event, secondary transactions are typically priced relative to the company’s most recent round of primary funding. The price can also be influenced by factors of supply and demand. If a private company is in high demand, the shares might trade at a premium in the secondary markets (in other words, the shares would be priced higher than the price per share from the most recent round of funding). If there are more sellers than there are buyers for a particular security or if market multiples have compressed, the shares might trade at a discount (lower than the price from the most recent round of funding).

Aside from the influences of supply, demand and market multiples, there are other factors that can affect the price per share of private market secondaries:

- Share Class: Two of the primary share types are preferred stock and common stock.

- Preferred stock is typically issued to investors and holds certain rights over common stock. These rights may include, but are not limited to liquidation preferences, dividends, anti-dilution clauses, and managerial voting power.

- Common stock is most frequently issued to founders, management, and employees. In a liquidation event, preferred shares generally take priority over common shares.

- Preferred stock, given its structural seniority, generally commands a higher price per share than common stock.

- Share Class: Two of the primary share types are preferred stock and common stock.

- Discount for Lack of Marketability: A valuation discount exists between stock that is publicly traded and liquid, and stock that is not publicly traded and illiquid. Because private secondary offerings are relatively illiquid, it’s not uncommon for shares to price at a discount to the most recent round of primary financing.

A framework for evaluating investment opportunities

Now that you understand secondary market mechanics, it’s time to consider investment opportunities. The framework below will help you think through the key components of a pre-IPO investment, craft an investment memo and, ultimately, make an investment decision.

Overview. A clear, concise overview of the approach that the company is taking to capitalize on a market opportunity. What does the startup do, and how does it generate revenue?

- What does the company do?

- How do they differentiate themselves from competitors?

- What makes this company's product unique?

- How does the company generate revenue?

Market. An analysis of the size of the market that the target company is seeking to capitalize on.

- What is the total addressable market (TAM)?

- If revenue figures are available, what is the company's market penetration at the time of your analysis?

- How much more market share can the company capture if things go according to plan?

- What is the company's go-to-market strategy?

- Who are their customers & how many customers do they have?

Team. A quick summary of the leadership team’s background. What gives each key team member an edge?

- Past experience & expertise

- Have they started and exited a company in the past?

- Do they have strong knowledge of the market in which they are operating?

- Has the company hired a CFO? Does that CFO have experience taking other companies public or through acquisitions?

- Has the company hired outside board members or advisors? How can they add value?

Why they win. What makes this company great? If you can find customer testimonials, this would be a great place to add them.

- What makes customers choose to pay for the product?

- Is the product an order of magnitude better than competing products?

- Does the product save time and money for their customers?

- Does the product help customers generate revenue?

- Have their customers switched from incumbent / legacy player? Why?

Investment terms & comparable analysis. Outline the terms at which you'll be investing and how the company stacks up against its competitors.

For your analysis and for record keeping, it will be helpful to outline investment terms, including:

- Price per share

- Valuation from the company's last round of financing

- Implied valuation based on the price per share of your investment

- % premium / discount

- Deal structure

- Investment Amount

Next, pull financial details for the company and its existing private, public and previously acquired competitors. Helpful metrics, where available, include:

- Enterprise value, if public; valuation from last financing round, if private

- Amount of capital raised, if private

- Last Twelve Month (LTM) Revenue

- LTM Price to Sales (P/S) or LTM Enterprise Value to Sales (EV/S) Multiple

- Growth rate

Calculating multiples for your target company and its competitors will allow you to compare your target company to its peer group on a relative basis and will put you in a better place to estimate the value of your potential investment. For publicly traded competitors, you'll find this information and more in annual 10-K's, quarterly 10-Q's and on websites like Yahoo Finance and publiccomps.com. For private companies (including the one you're evaluating), you'll have to get creative by finding research and articles online. At the bottom of this article, you’ll find a list of resources that our Investment team uses to source information on private companies.

Devote some time to searching online for companies that operated in the same sector and were ultimately acquired. If any competitors from the peer group were acquired recently (within the past 5 years), you can conduct a precedent transactions analysis. This analysis will give you a clearer picture of what an exit might look like for your target company and will also highlight trends in the industry that you should be aware of.

Once you've identified relevant transactions, you'll need to search for the price paid by the acquiring company and the most recent revenue metric known at the time of each acquisition. Use this information to calculate the multiple of revenue that the acquiring company paid for each acquisition.

Now that you've calculated revenue multiples from recent acquisitions, you can apply the average, median, max and/or minimum of the data set to your target company's most recent revenue figure. This will provide you with an estimate of the valuation that your target company might achieve if it were to be acquired.

Ascribing a valuation to a private company can be an exercise in assumptions and best guess estimates, but the analysis outlined in this section should help you get a sense for where your target company fits in the market.

Highlights. Compile a handful of bullet points on why your target company makes a compelling investment opportunity. Each investment will have its own unique highlights, for example:

- Has your target company reached product market fit?

- Is the company profitable? Does it have a strong balance sheet?

- Have top-tier Venture Capital investors invested in the company?

- Do you have the opportunity to purchase shares at a compelling valuation?

- Is the company quickly gaining market share in a large and growing market? Do they have room to grow?

Risks. Outline what could go wrong and, if applicable, how the company is taking steps to mitigate those risks. These risks will be unique to your target company at the time of analysis and could include things like economic risk, competition risk, financial risk & operational risk.

It’s important to note that pre-IPO investments may be speculative, and there can be no assurance that any private company will go public or be acquired, or that any IPO or acquisition will result in a successful investment.

Outcomes. List out potential outcomes for your investment. Use the information you gathered in your Comparable analysis, Highlights and Risks sections to estimate a base, bull and bear case for your investment. EquityZen provides its investors with a scenario generator as part of the Offering Document for a given company to help quantify exit scenarios as well.

Investment Decision. If you've gotten this far, you're ready to make an investment decision. Nice work! As you continue learning more about the private markets, this process will become second nature.

EquityZen’s goal is to make the pre-IPO Investment process as easy as possible for our clients. If you’re interested in buying or selling shares of pre-IPO companies through an EquityZen fund or learning more, you can sign up for EquityZen, check out our other blog posts, or connect with one of our Investment Associates.

![]()

Interested in exploring the private companies trading on EquityZen's marketplace?

Additional resources for researching private companies:

- Atom Finance is a public market data provider. They have a tool called “X-Ray” that allows you to search for the names of private companies within public filings.

- Public Comps is helpful for benchmarking against public SaaS companies.

- Getlatka.com is a source on information for top SaaS companies & podcasts with founders.

- Google & YouTube is a source for interviews & articles featuring company leadership

Sources: