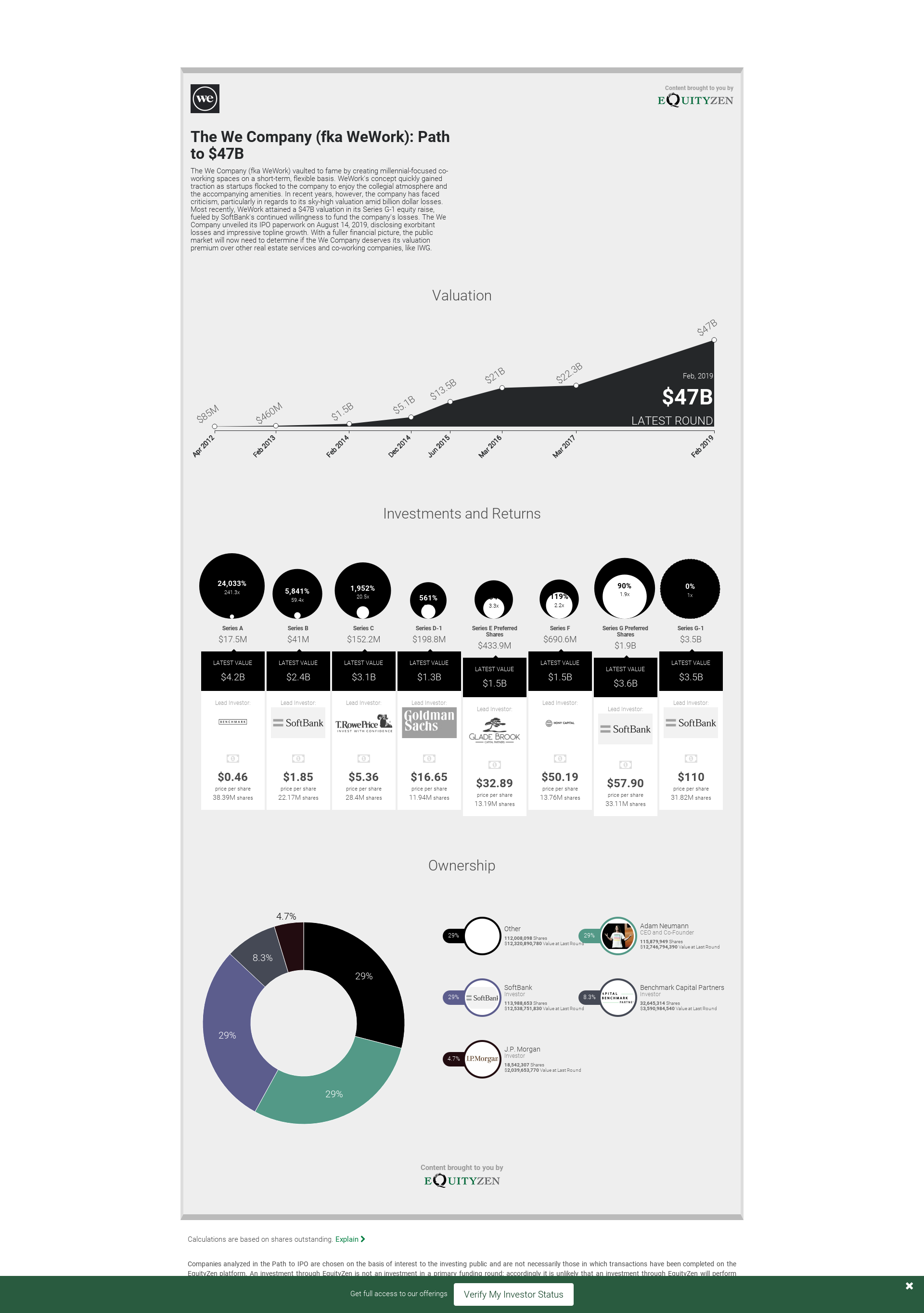

The We Company (fka WeWork) vaulted to fame by creating millennial-focused co-working spaces on a short-term, flexible basis. WeWork's concept quickly gained traction as startups flocked to the company to enjoy the collegial atmosphere and the accompanying amenities. In recent years, however, the company has faced criticism, particularly in regards to its sky-high valuation amid billion dollar losses. Most recently, WeWork attained a $47B valuation in its Series G-1 equity raise, fueled by SoftBank's continued willingness to fund the company's losses. The We Company unveiled its IPO paperwork on August 14, 2019, disclosing exorbitant losses and impressive topline growth. With a fuller financial picture, the public market will now need to determine if the We Company deserves its valuation premium over other real estate services and co-working companies, like IWG.