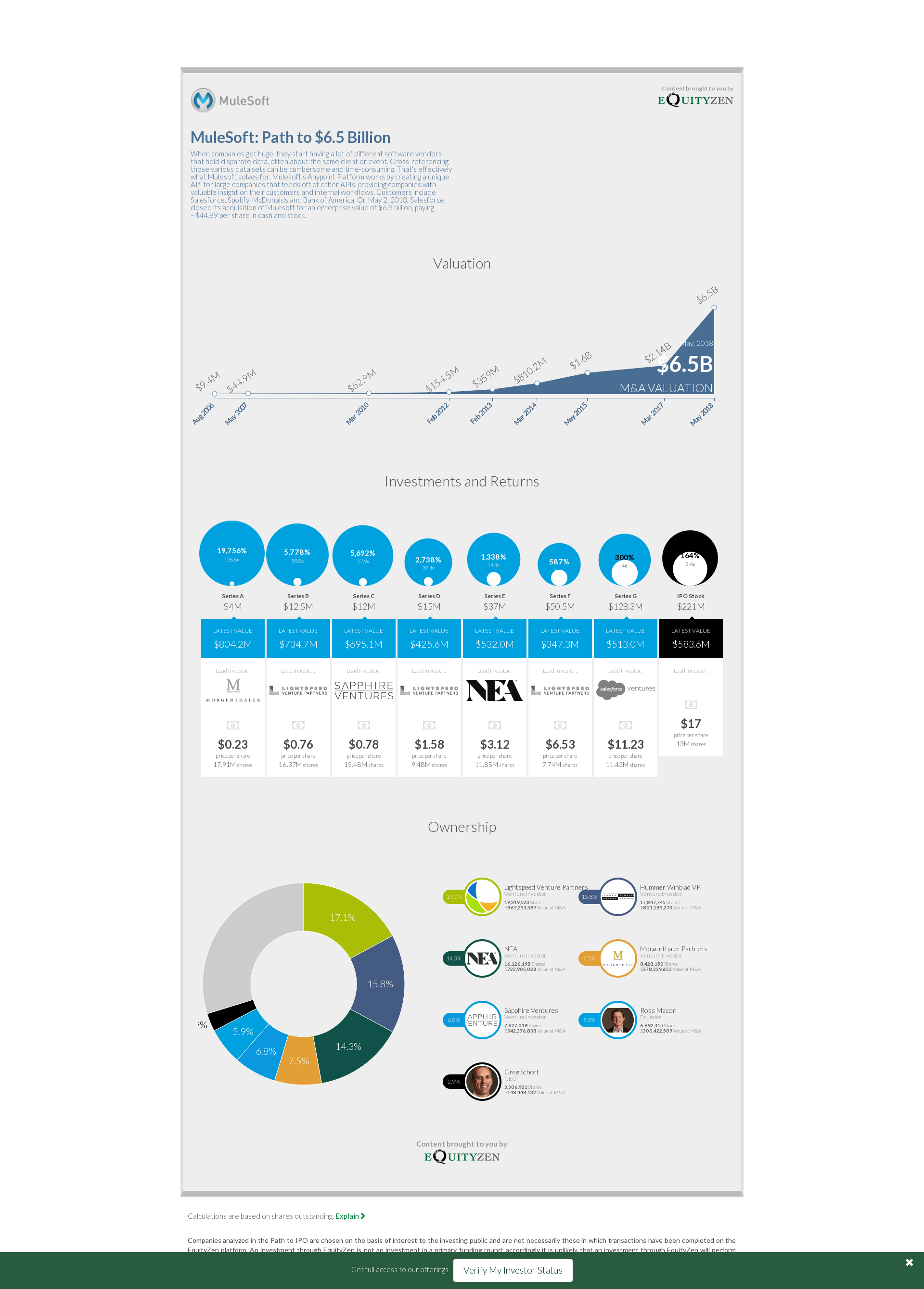

When companies get huge, they start having a lot of different software vendors that hold disparate data, often about the same client or event. Cross-referencing those various data sets can be cumbersome and time-consuming. That's effectively what Mulesoft solves for. Mulesoft's Anypoint Platform works by creating a unique API for large companies that feeds off of other APIs, providing companies with valuable insight on their customers and internal workflows.

Customers include Salesforce, Spotify, McDonalds and Bank of America. On May 2, 2018, Salesforce closed its acquisition of Mulesoft for an enterprise value of $6.5 billion, paying ~$44.89 per share in cash and stock.