Sign Up Today and Learn More About ABL Space Systems Stock

Invest in or calculate the value of your shares in ABL Space Systems or other pre-IPO companies through EquityZen's platform.

ABL Space Systems Stock (ABSS)

Low-cost satellite carrier rockets

About ABL Space Systems Stock

Founded

2017

Total Funding

401M

Industries

Software, Artificial Intelligence, Data and Analytics

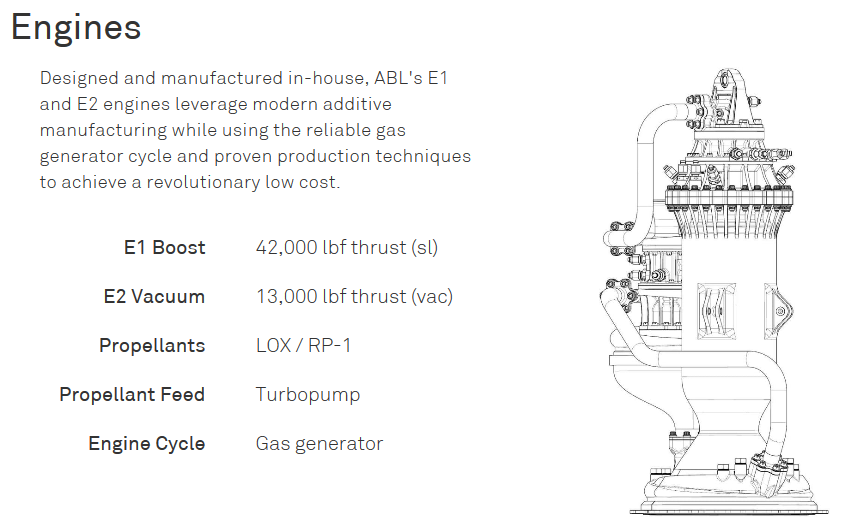

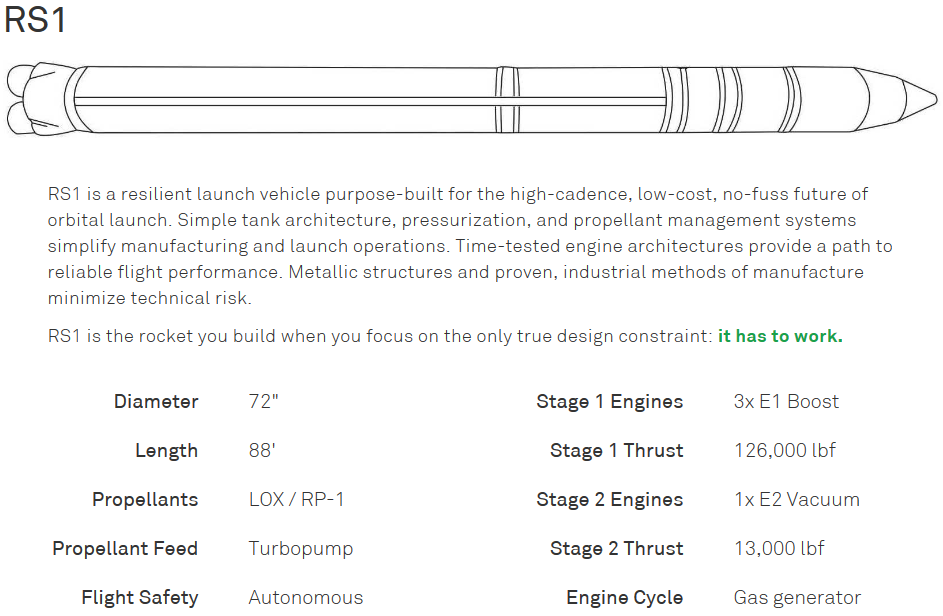

According to ABL Space Systems, the Company designs, builds and operates a low-cost rocket used as a launch vehicle for small satellites called the RS1. The Company also designs and builds its own family of rocket engines, called the E1 and E2. Below are exhibits of ABL Space Systems' engine family and launch vehicle.

ABL Space Systems

Source: ABL Space Systems

According to ABL Space Systems, at a 1,200 kg payload capacity, the RS1 aims to provide meaningfully more payload capacity than many nanosatellite launchers. The RS1 can carry single large satellites or a combination of many 150kg to 350kg satellites to Low Earth Orbit. Additionally, ABL's launch systems and RS1 launch vehicle are packaged into shipping containers, making the entire launch pad mobile and deployable. For commercial satellite operations, ABL aims to enable the flexibility to launch from any FAA-licensed fixed launch site with ease. For government space resiliency efforts, ABL’s deployable launch system aims to give Department of Defense and Intelligence Community customers the ability to launch satellites from distributed, non-traditional launch sites.

ABL Space Systems has a 20,000 square foot facility for research, development, and production in El Segundo, California and has also established a test site in Camden, Georgia with 10,000 square feet of integration and testing facilities and a 250 acre test site. Moreover, the Company has a private engine test site in Las Cruces, New Mexico.

ABL Space Systems was founded in 2017 and is headquartered in El Segundo, California. The Company has a team of over 20 aerospace engineers with prior experience at SpaceX, Virgin Orbit, Boeing, Lockheed Martin, Pratt + Whitney, and elsewhere.ABL Space Systems Press Mentions

Stay in the know about the latest news on ABL Space Systems

Heart Aerospace Appoints Brittany Churchill as Vice President of Operations

news • Jun 10, 2025

Multi-part fluid chamber and method of manufacturing

patents • Feb 07, 2025

How Elon Musk crashed Scotland’s space race

telegraph • Dec 17, 2024

The Crunchbase Tech Layoffs Tracker

news • Sep 06, 2024

ABL Space Systems lays off staff

spacenews • Aug 31, 2024

Investors in ABL Space Systems

Discover investors in ABL Space Systems stock and explore their portfolio companies

ABL Space Systems Management

Leadership team at ABL Space Systems

Chief Executive Officer

Harry O'Hanley

Chief Engineer

Darin Van Pelt

Join now and verify your accreditation status to gain access to:

- ABL Space Systems Current Valuation

- ABL Space Systems Stock Price

- ABL Space Systems Management

- Available deals in ABL Space Systems and all other companies with relevant Deal Offering documents

- EquityZen's proprietary data and insights, which may include

- ABL Space Systems Cap Table and Funding History by Share Class and Liquidity Preferences

- ABL Space Systems Revenue and Financials

- ABL Space Systems Highlights

- ABL Space Systems Business Model

- ABL Space Systems Risk Factors

- ABL Space Systems Research Report from SACRA Research

Trading ABL Space Systems Stock

How to invest in ABL Space Systems stock?

Accredited investors can buy pre-IPO stock in companies like ABL Space Systems through EquityZen funds. These investments are made available by existing ABL Space Systems shareholders who sell their shares on our platform. Typically, these are early employees who need to fund a life event – house, education, etc. Accredited investors are then offered the opportunity to invest in this stock through a fund, like those used by hedge funds serving large investors. While not without risk, investing in private companies can help investors reach goals of portfolio diversification, access to potential growth and high potential return. Learn more about our Guided Investment process here.

How to sell ABL Space Systems stock?

Shareholders can sell their ABL Space Systems stock through EquityZen's private company marketplace. EquityZen's network includes over 380K accredited investors interested in buying private company stock. Learn more about the easy and guided Shareholder process here.

If I invest, how do I exit my investment?

There are two ways to exit your private company investment on EquityZen's marketplace. The first is if the company has an exit event like an IPO, merger or acquisition. In that case, we will distribute the shares and/or cash to you directly. The second way is through an Express Deal on EquityZen, if eligible. An Express Deal allows you to sell your allocation of private shares in a given private company to another investor on EquityZen's marketplace. More information on Express Deals can be found here and exit information can be found here.

Why choose EquityZen?

Since 2013, the EquityZen marketplace has made it easy to buy and sell shares in private companies. EquityZen brings together investors and shareholders, providing liquidity to early shareholders and private market access to accredited investors. With low investment minimums through our funds and with more than 47K private placements completed across 450+ companies, EquityZen leads the way in delivering "Private Markets for the Public."