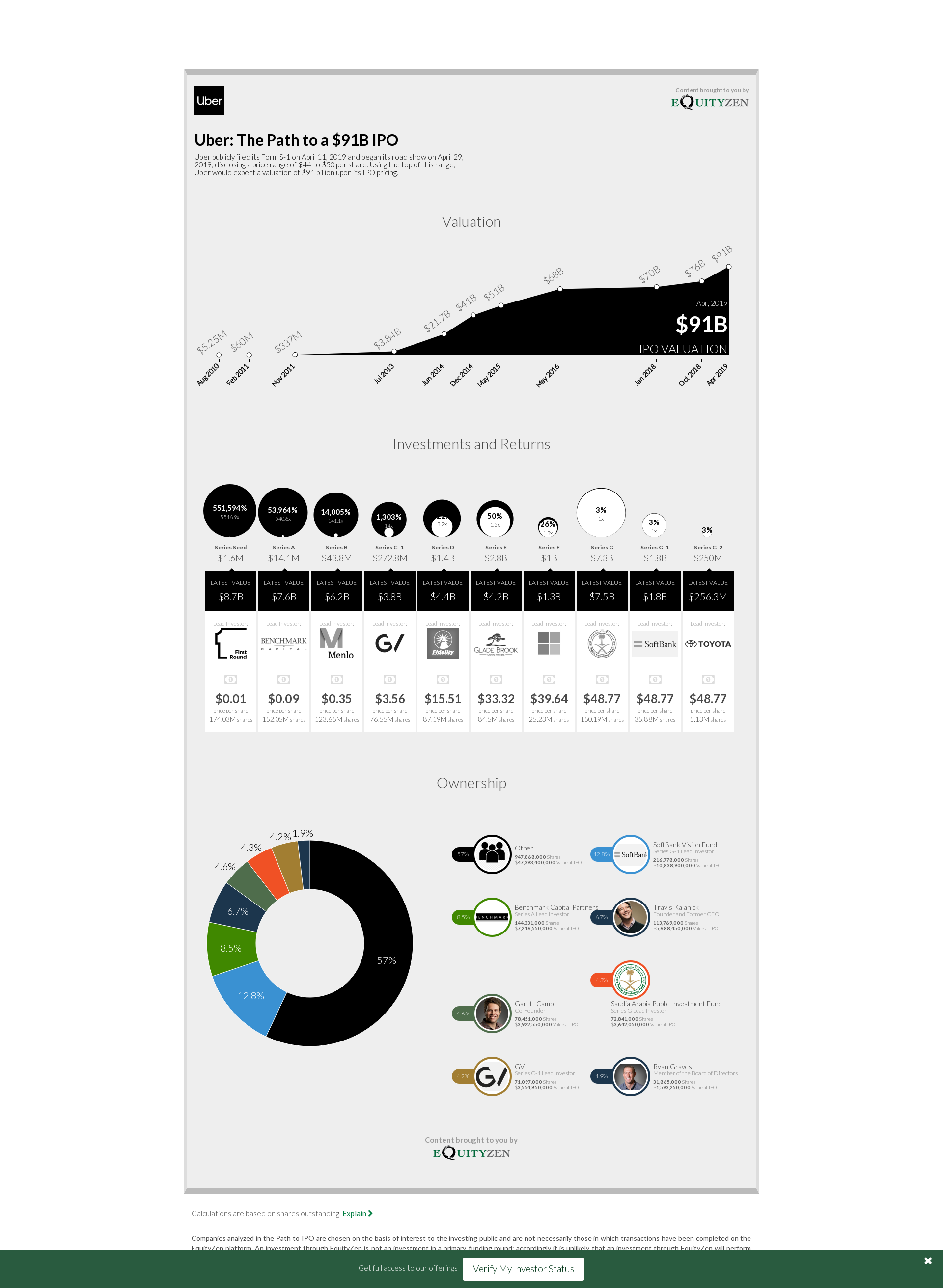

Uber publicly filed its Form S-1 on April 11, 2019 and began its roadshow shortly thereafter. The company was met with investor concern regarding its lack of profits and ability to compete domestically and internationally. Additionally, Lyft's post-IPO decline weighed on Uber's pricing prospects. Not looking to repeat Lyft's stumble, the company settled on a $45 share price or an $82B valuation, on the low end of its $44 to $50 initial share price range.