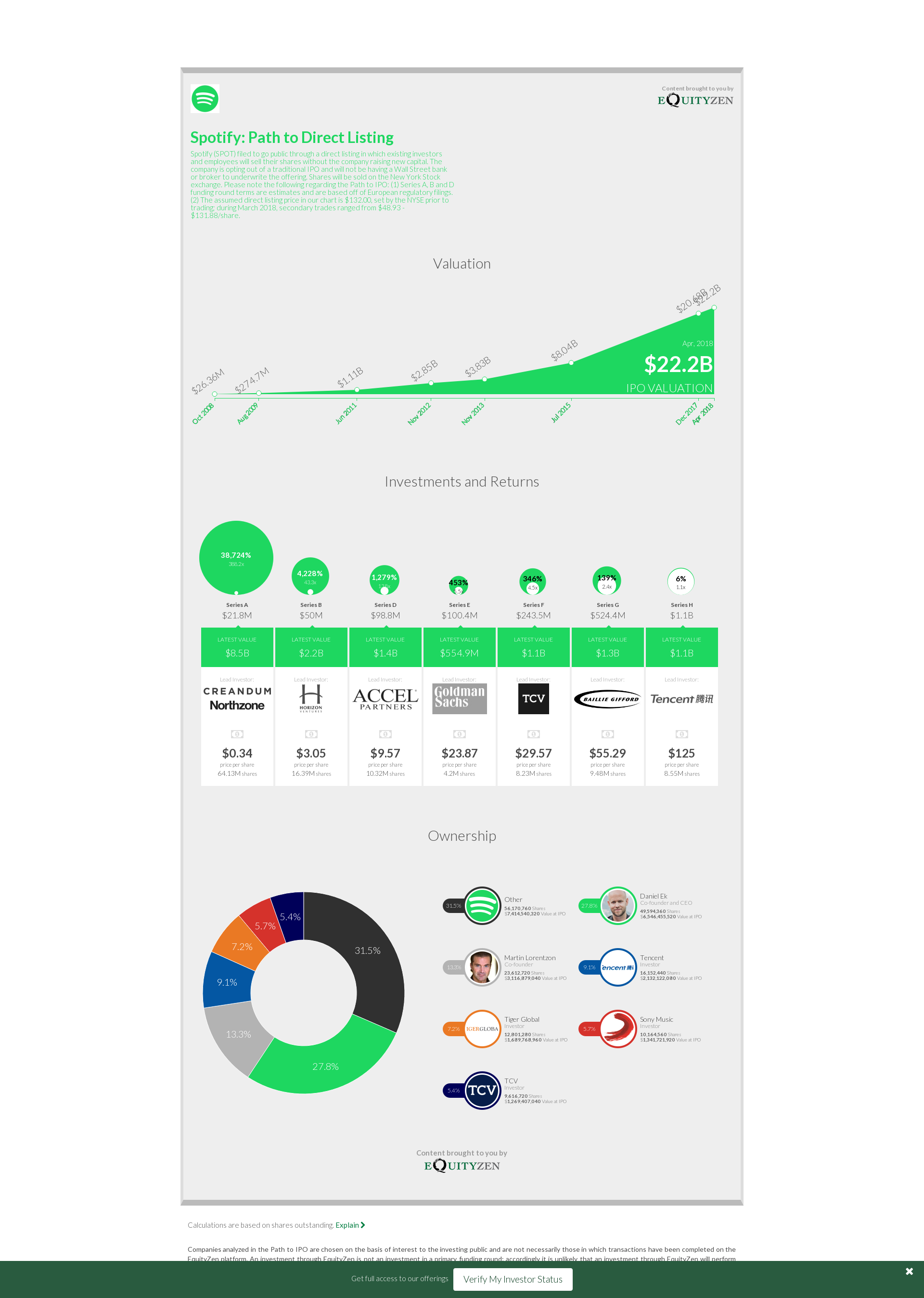

Spotify (SPOT) filed to go public through a direct listing in which existing investors and employees will sell their shares without the company raising new capital. The company is opting out of a traditional IPO and will not be having a Wall Street bank or broker to underwrite the offering. Shares will be sold on the New York Stock exchange.

Please note the following regarding the Path to IPO: (1) Series A, B and D funding round terms are estimates and are based off of European regulatory filings. (2) The assumed direct listing price in our chart is $132.00, set by the NYSE prior to trading; during March 2018, secondary trades ranged from $48.93 - $131.88/share.