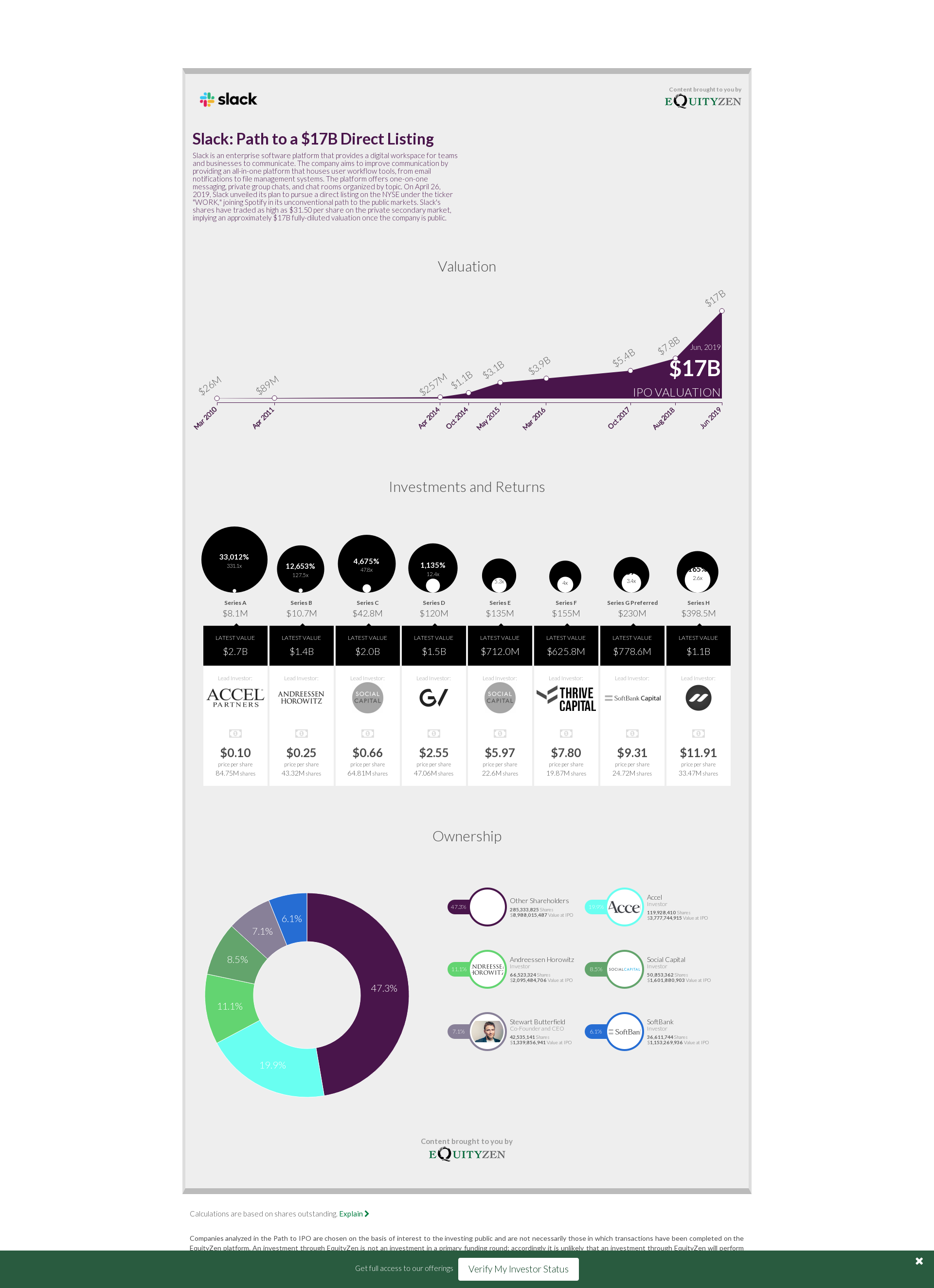

Slack is an enterprise software platform that provides a digital workspace for teams and businesses to communicate. The company aims to improve communication by providing an all-in-one platform that houses user workflow tools, from email notifications to file management systems. The platform offers one-on-one messaging, private group chats, and chat rooms organized by topic. On April 26, 2019, Slack unveiled its plan to pursue a direct listing on the NYSE under the ticker "WORK," joining Spotify in its unconventional path to the public markets. Slack's shares have traded as high as $31.50 per share on the private secondary market, implying an approximately $17B fully-diluted valuation once the company is public.