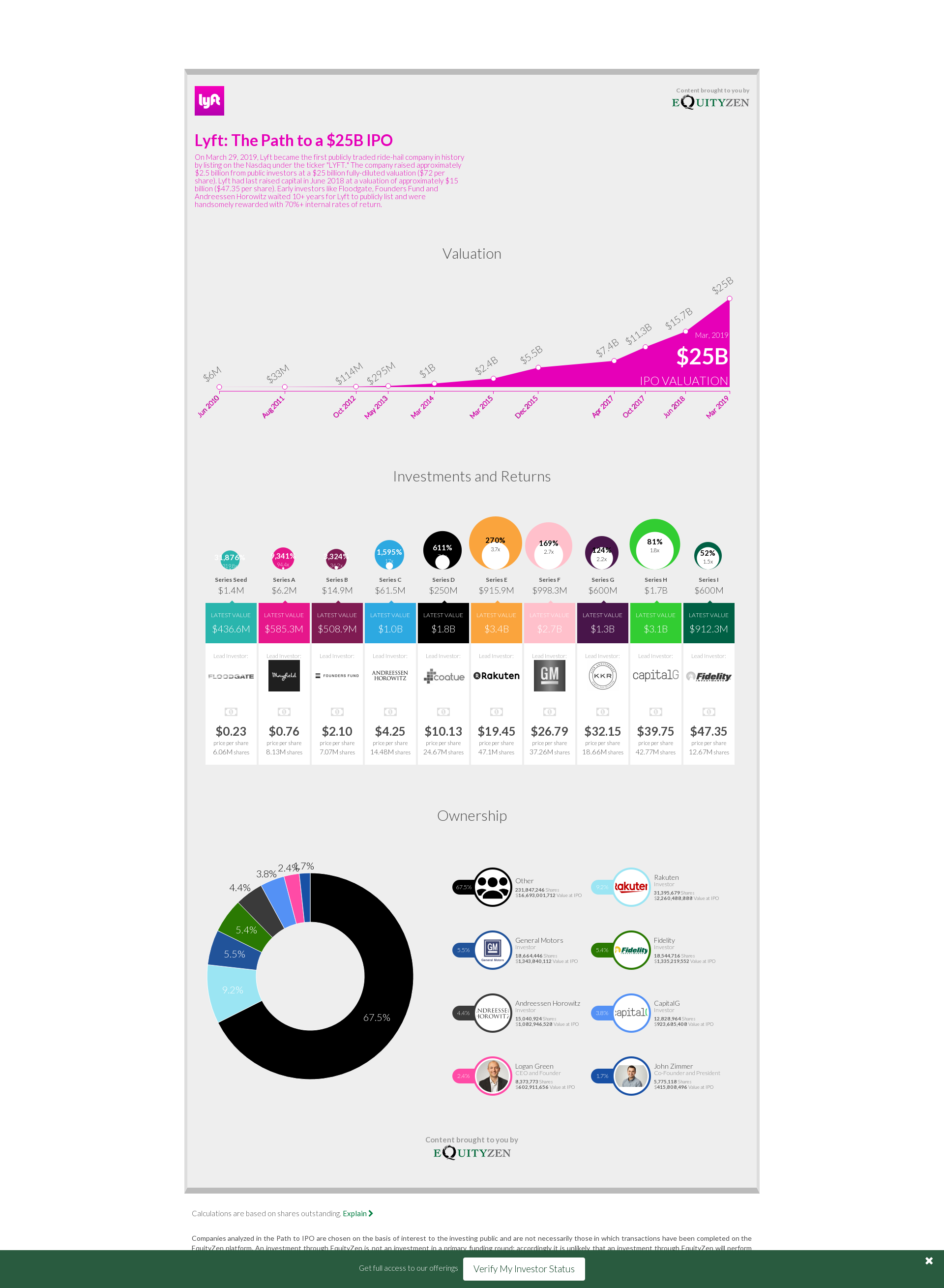

On March 29, 2019, Lyft became the first publicly traded ride-hail company in history by listing on the Nasdaq under the ticker "LYFT." The company raised approximately $2.5 billion from public investors at a $25 billion fully-diluted valuation ($72 per share). Lyft had last raised capital in June 2018 at a valuation of approximately $15 billion ($47.35 per share). Early investors like Floodgate, Founders Fund and Andreessen Horowitz waited 10+ years for Lyft to publicly list and were handsomely rewarded with 70%+ internal rates of return.