Access Late-Stage Tech And Explore Investment Opportunities On EquityZen.

Explore our pre-IPO platform now.

Is Slack Worth $17 Billion?: Grading Slack On Ten Metrics

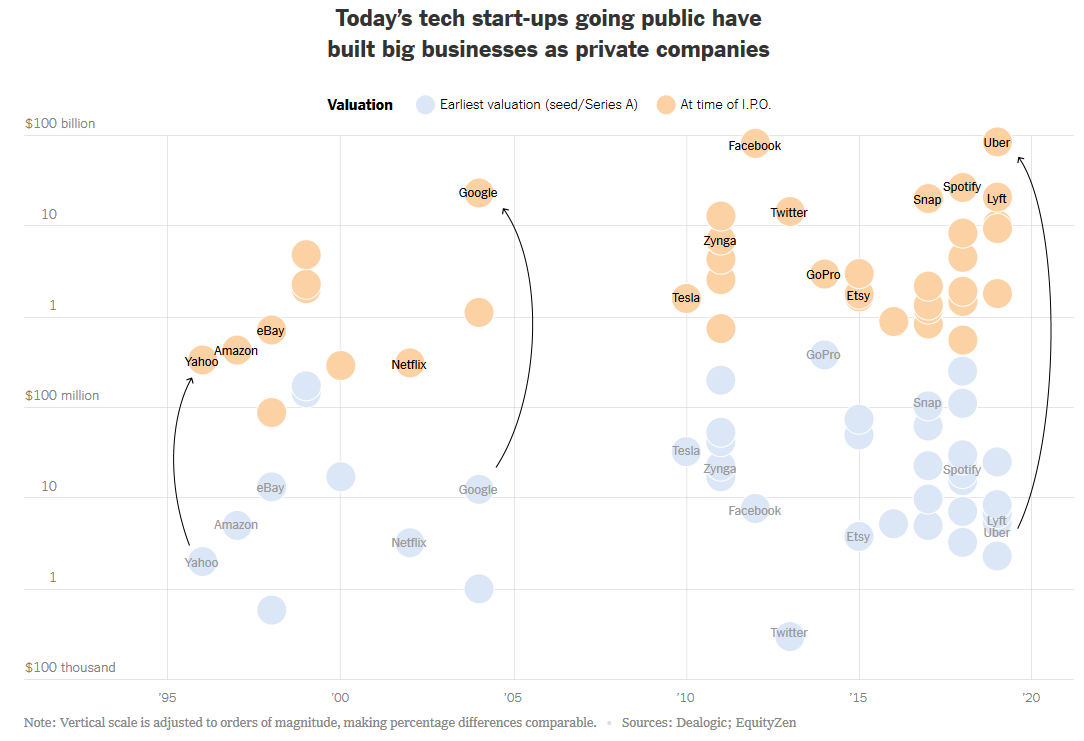

Slack Technologies, the enterprise SaaS company that provides a cloud-based set of team collaboration tools, will become only the second large company to publicly debut through a direct listing when it begins to trade on the NYSE on Thursday, June 20, 2019. Rumored valuations indicate Slack will debut at nearly a $17 billion market capitalization. Is this valuation justified? We benchmarked Slack against 20 of its peers to find out. Download our full report for more.

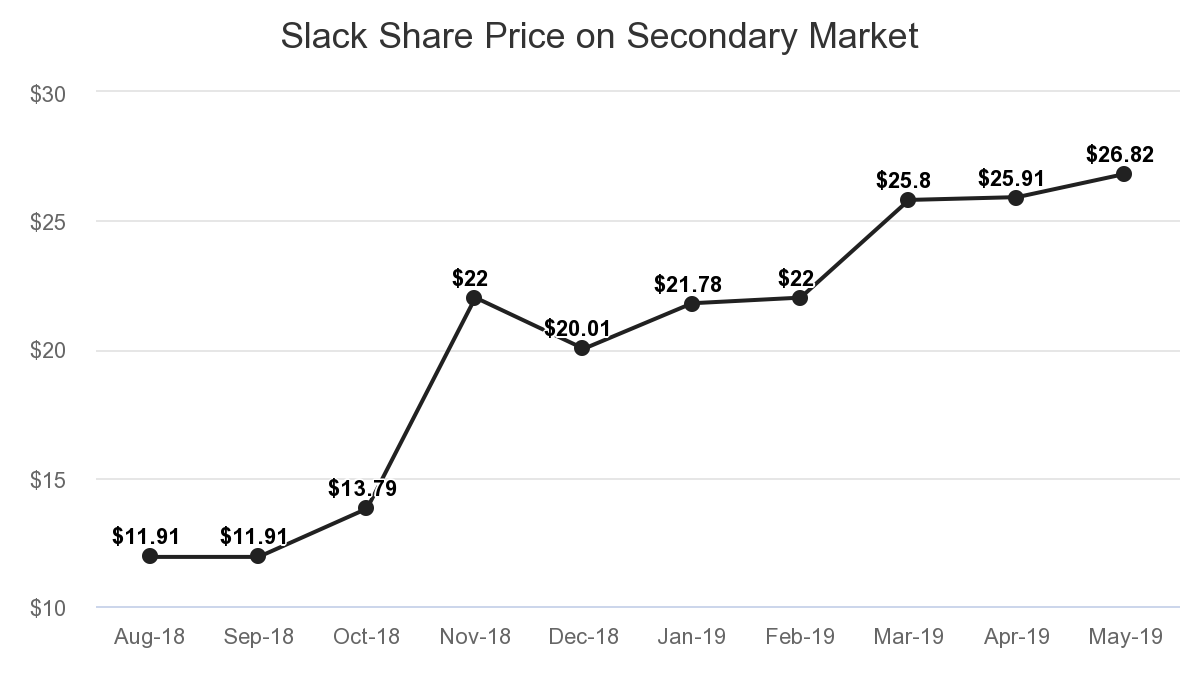

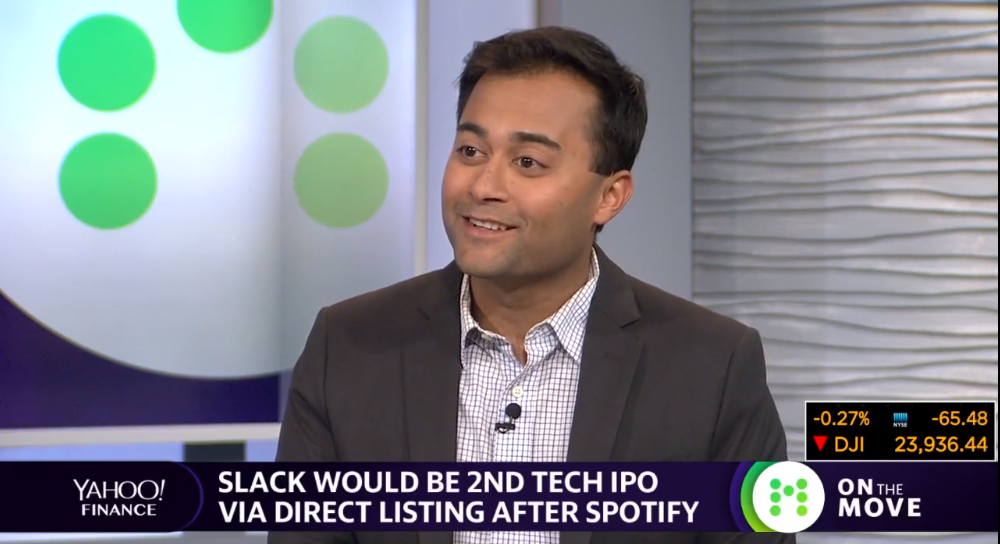

"Slack followed Spotify’s lead in allowing more trading volume of its privately held shares on the secondary market in the months leading up to its direct listing, giving it more data points to consider in determining a price for its public debut."

- Phil Haslett, Chief Strategy Officer, Co-Founder of EquityZen

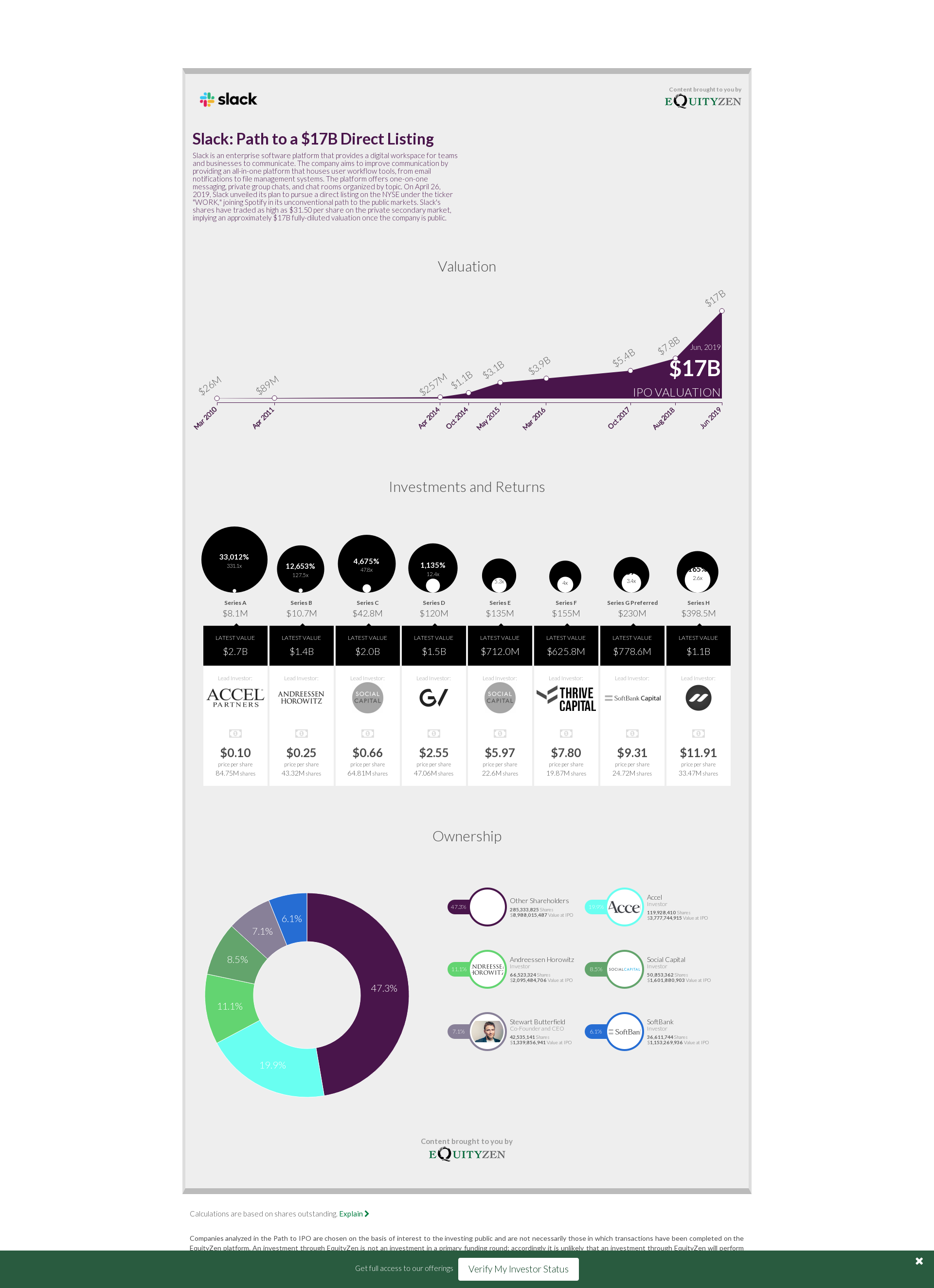

Slack: Path to a $17B Direct Listing

Slack is an enterprise software platform that provides a digital workspace for teams and businesses to communicate. The company aims to improve communication by providing an all-in-one platform that houses user workflow tools, from email notifications to file management systems. The platform offers one-on-one messaging, private group chats, and chat rooms organized by topic. On April 26, 2019, Slack unveiled its plan to pursue a direct listing on the NYSE under the ticker "WORK," joining Spotify in its unconventional path to the public markets. Slack's shares have traded as high as $31.50 per share on the private secondary market, implying an approximately $17B fully-diluted valuation once the company is public.