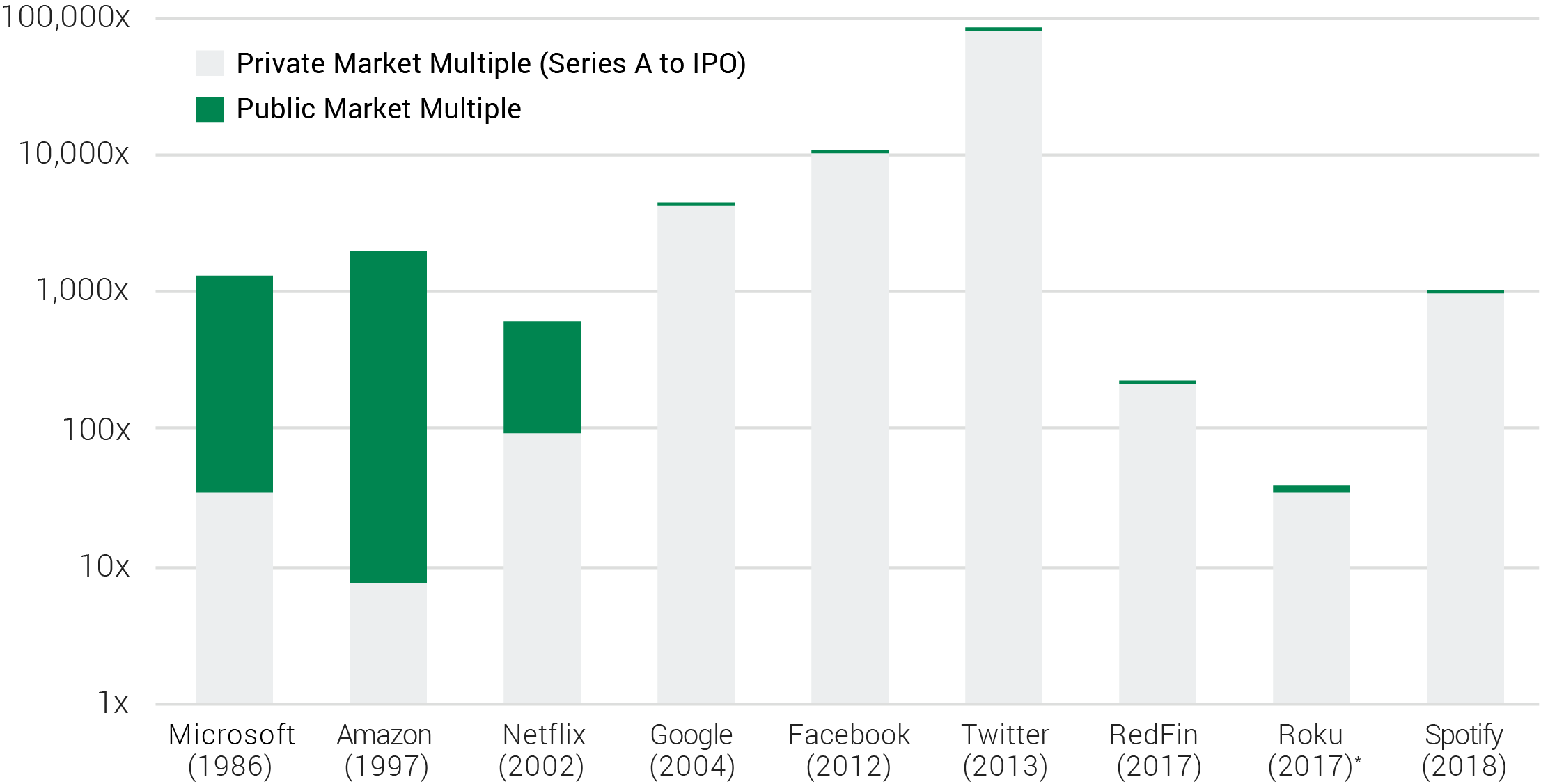

Value creation in technology-enabled companies is increasingly occurring in the private markets. In 2004, companies typically went public after 4 years, today the average company IPOs after 10+ years.

Until recently, access to pre-IPO companies has been limited. EquityZen is here to change that.