“EquityZen is unlocking one of the greatest untapped opportunities in the capital markets - the private company secondary equity market... I invested in EquityZen because the founders have the vision and DNA to create a private stock market platform on a massive scale.”

—Kevin Moore,

Investor

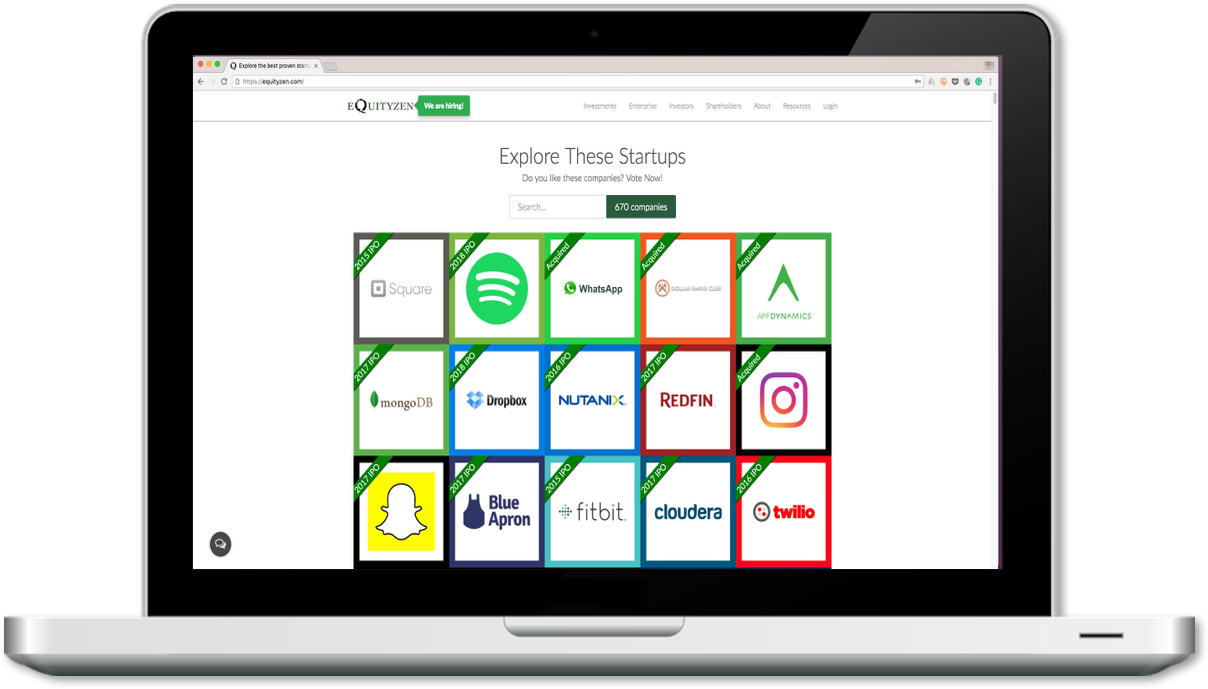

Access proprietary analysis including recent price history, valuation, and cap table. Up-to-date reporting of company news and funding rounds, along with our Private Market Sentiment Index

Browse private company investment opportunities you won’t find elsewhere. Our easy-to-use marketplace features live deals in premiere private companies.

We never share your private and financial information. Ever. Your trust is our number one priority.

EquityZen provides alternative investment opportunities in late-stage private technology companies. Now, accredited investors can get access to pre-IPO companies and proven startups.

Typically, private investment opportunities were hard to find and curate for the average accredited investor. EquityZen works with private company shareholders to provide a range of investment offerings.

We buy shares from current shareholders in leading tech companies.

Our current investor clients include:

Investments in private placements holding pre-IPO companies are speculative, illiquid, and carry a high degree of risk, including loss of principal. Investments made on the EquityZen platform are made through pooled investment vehicles, which acquire shares of private technology companies, and are not direct investments in these companies.

“EquityZen believes it has found an alternative that avoids those hassles by allowing employees to sell the rights to the cash their shares will fetch when their company goes public or is acquired.”

“[Secondary markets] allow for different classes of companies that can encourage trading of their shares if it suits their business needs and objectives.”

Easily research, compare, and reserve investments today.