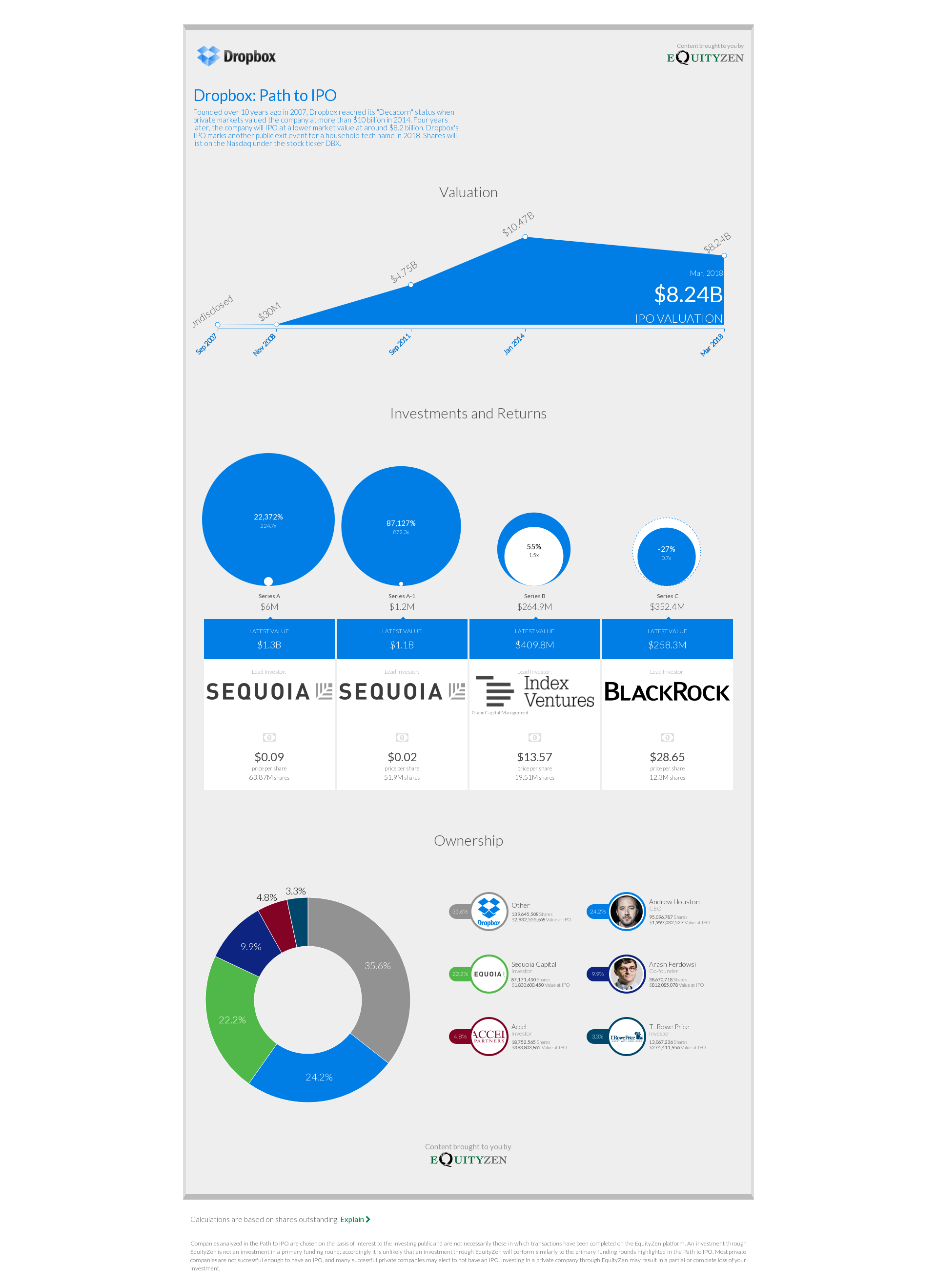

Founded over 10 years ago in 2007, Dropbox reached its "Decacorn" status when private markets valued the company at more than $10 billion in 2014. Four years later, the company will IPO at a lower market value at around $8.2 billion. Dropbox's IPO marks another public exit event for a household tech name in 2018. Shares will list on the Nasdaq under the stock ticker DBX.